Why Do We Love Social Investing?

Understanding the stock market can be overwhelming - but could Public's novel approach to investing change the culture in the long run?

When I was fourteen years old, my uncle helped me start my first stock portfolio.

Until I was ready to make my own decisions, it was mostly driven by him. In my final year before college, my uncle’s involvement slowed.

He began to hand it off and it was the moment I had been waiting for. The ability to sell and buy whatever I wanted.

There was only one problem: I had no idea what I was doing.

I sat in my college dorm, confounded by the ETFs, hospitality holdings, and pharmaceutical stocks, scanning terms like SPDR and “money market” for any clues into my uncle’s brain.

If I thought this would suddenly motivate me to read more about stocks, I was sadly mistaken. My college years collided with the rise of time-binding social apps - any hopes of me browsing Investopedia and Yahoo Finance were quickly sucked up by time I instead spent on Facebook and Twitter.

What once started as a fun learning opportunity slowly turned into a paralyzing chore. Logging into Fidelity felt like its own form of suffocation.

But, I would soon find I was far from alone.

Many studies reveal a pattern: Lots of Americans are confused about basic finances when it comes to stock. A study shows that almost 49% of Americans in the sample could not explain index funds and a further 39% couldn’t explain mutual funds. In another survey, when Americans were asked if buying a single company’s stock usually provides a safer return than a stock mutual fund, 40% of respondents said they didn’t know the answer.

So, is there hope for us?

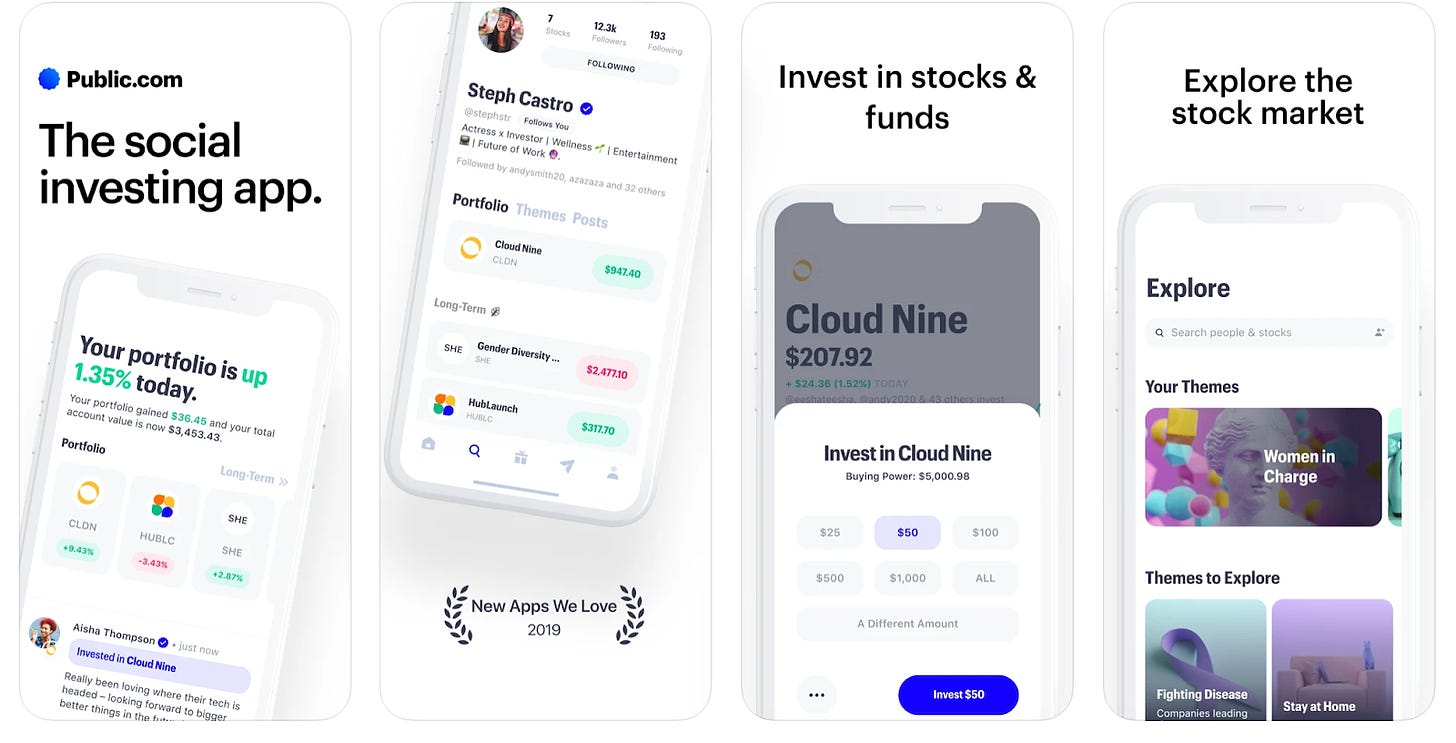

Last August, I discovered an investing social network called Public.com, an app designed to help you invest and make the stock market more social.

The features look familiar for anyone who loves social networking apps: Similar to a Facebook or Linkedin, you can react and comment on different insights with a range of emoticons. Similar to a Twitter, you can join group chat messages and follow other profiles. Somewhere between a Venmo and Facebook feed, you even have a news feed of commentary, actions, and trades from friends.

But if you think that it’s a simple ecosystem of friends recommending stocks, Public provides even more: curated themes, a range of information on single stock pages, recent articles about stock trend and regular information sessions to filter through the realities of investing.

After some months on the app, I found that I had better instincts around trading and decent returns - but there was another unexpected outcome: I finally found investing fun.

I actually woke up and looked forward to logging into the app, even if I had nothing to trade.

I was curious, more self-aware, and much more relaxed - the paralysis I had from trying to decipher my uncle’s portfolio slowly vaporized into genuine enthusiasm.

It got me curious about why this worked so well.

What did Public seem to do that was so compelling?

What does it tell us about investing and our reliance on social networks in general?

I reflected more on Public’s features, my own experiences - and slowly begin to pick apart the allure of this new concept of social investing.

What Stops Us From Investing In Stocks?

I started by reflecting on something simple:

Why create a new investing app?

What brought us to a need for a social network-based investing app in the first place?

We generally know why people invest in stocks. In addition to the potential for financial growth, there’s also the exciting prospect of owning a piece in a company you care about and admire. Semantically, if you own AAPL stock, Tim Cook works for you!

But there’s also a dark side: the stock market has a long history of irrational behavior when it comes to investing.

Behavioral Economist Richard Thaler has written about a concept called mental accounting, a bias investors are highly prone to.

A large part of invested money is considered play money, likely due to the volatile nature of the market. Money you can afford to lose.

The problem, of course, is that “money you can afford to lose” is a purely mental creation. It’s the same as any other money.

But the more we categorize investment money this way, the less safe we find ourselves in making safe investments.

Moreover, the effects of cognitive dissonance also prevent investors from acting rationally. Losing a lot of money in the market is one thing, but the need to maintain self-esteem and ego makes investors rationalize bad decisions to chance instead of believing they made any bad calls.

This is all on top of emotionally driven decisions, characterized by FOMO (Fear of Missing Out) and FOLE (Fear of Losing Everything) actions. The first can lead to a lot of speculative decision-making because others are doing it (Remember when everyone bought those initial coin offerings?) and the latter can lead to people sidelining all their investments to avoid a big crash, ultimately absorbing short losses in the process.

When you consider that only 50% of Americans actually own any stocks, you can start to understand why. Of course, there are a fair number of economic barriers to entry - but there is also a large psychological fear of putting your money in a black box full of volatility. The horror stories certainly don’t help.

Morgan Housel has a great anecdote in his book Psychology of Money:

“Your personal experiences with money make up maybe 0.000000001% of what’s happened in the world, but maybe 80% of how you think the world works.”

So how do we change our understanding of how the world works?

I do think this is solvable: being able to get flags, more education around volatile market changes, reassurance around safe investing and more justification around investments can all help curb our biases.

That’s where I’m bullish about the work being done by Public and the future of integrating social networks with investing.

Luckily, along with my own research, I got a chance to chat with Katie Perry, VP of Marketing at Public, who was excited to share some of her thoughts on the company’s work. When I asked Katie how she viewed Public’s mission in making investing more inclusive, she responded with a great vision:

“There are many people who believe that investing is out of their reach. It’s for a certain profile of person, and is too complex to even broach. This is why our mission at Public is to help change the very culture of investing.”

At a macro-level, Katie describes it as “humanizing the stock market” - acknowledging that we are all emotional actors prone to messy decisions, and that more learning and collaboration can help us navigate the complexity.

How does Public approach this?

Let’s get into the features of social investing.

How Does Social Investing Work?

While many jokingly assume the typical investor is an old, white man, this was fairly true for a number of years. The first woman to buy a seat on the NYSE, Muriel Siebert, didn’t do so until 1967. The first two black owned and operated firms to buy NYSE seats, First Harlem Securities and Daniels & Bell, didn’t arrive until 1971.

For context, the NYSE had existed at this point for over 170 years.

I mentioned above Public’s mission to humanize and effectively democratize education around the stock market - but what I found fascinating from chatting with Katie was just how many different ways Public approached this, starting from a goal to ensure that there is a diverse representation in the community of race, gender, socioeconomic status, and professional background.

What’s interesting right off the bat if you scroll to the Public feed is that there is effectively no big psychological gatekeeping on who gets to participate in the conversation.

In the mix of well-known entrepreneurs, professional investors, and writers - there are average people curious about Tesla, stock jumps, IPOs, and general saving advice, as well as even the occasional light humor.

Katie confirms that new investors are a big focus of Public’s community features:

“We do a lot of Investing 101-style talks with our community partners. I love these because they prove that just because someone hasn’t invested before, doesn’t mean they’re not capable. For a lot of these people, they just haven’t felt like the culture and products supporting investing are for them. It’s a light-bulb moment for people when they begin to understand the nuances in different profiles of investors.”

On top of this, Katie adds that some of the best performing community posts tend to be inherently educational. Anything from breaking down an upcoming SPAC, sharing a point of view on a broad trend in business, discussing the SPAC trend, or opening up about a personal investing journey - clear answers to questions people may be afraid to ask in a traditional investing forum.

The other interesting element of Public’s social investing framework is how the community is able to react to news in real-time.

While the world was trying to figure out the validity of GME and other quick rising meme stocks, Public utilized a feature it has now had for a year: Safety Labels for potentially risky investments.

Safety Labels are designed to give investors additional context, before they make a self-directed investment based on their financial situation and risk appetite.

(Public also doesn’t encourage day trading, which is an important distinction since studies have shown that up to 80% of day-traders lose money in the market.)

What I find compelling is just how interesting this feature is in the lens of human psychology.

According to Investopedia, humans are anecdotally prone to chasing trends. Look no further than late January when Reddit stocks went viral - more people were searching “How to buy stocks” than ever before. In fact, behavioral finance research found that 39% of all of the new money committed to mutual funds went into the 10% of funds with the best performance the prior year.

The minute humans sense a pattern, they want in.

Public recognizes the inherent risk in some of these decisions and prompts you to recognize them as well.

Katie adds:

“When things are uncertain, changing quickly, or unfolding in real-time, we’ve seen that people don’t necessarily want to be alone with their charts and numbers. They want to collaborate with others to break down what’s going on.”

On top of dangerous situations, there’s also a fair amount of conversations that are just everyday curiosities around regular events.

How will Jeff Bezos stepping down impact Amazon stock? How will partnerships like Beyonce and Peloton impact Peloton stock? How does a decision that a company makes in area X impact the growth of area Y?

Public’s community members artfully field all these topics.

Even from just the Bumble IPO, I was excited to see four, five different conversations sparked from what the IPO meant from both a financial, brand, and historical standpoint.

In the fifteen years I’ve spent investing, many of them with my uncle, I don’t think I’ve ever even talked to him once about IPOs.

This is also an interesting insight into the mind of young and millennial retail investors, many of whom make up a large user base on Public.

Katie mentions a survey with 3,000 investors last year:

“We found that younger investors (under 30) were more likely to say they invest in companies whose values align with their own.”

While headlines might indicate that millennials are into meme stocks or simple well-known, consumer-friendly companies like Netflix and Apple, the experience of Public paints a different perspective: new investors are looking for novelty - to unpack the trends, business fundamentals, and cause and effect of companies they are less familiar with.

So Public has a regular social feed, education resources, and features that compel you to understand both investing 101, patterns, and events in real-time. '

But there’s another aspect of Public that is even more compelling: You can have friends!

On top of existing friends you have on Twitter, you can make new connections on the app as well as connect with entrepreneurial figures you know and admire.

One of my favorite features is the ability to pull up a stock and see which of your friends are investing or watching the same stock, setting you up for an in-network sounding board if you have questions.

In some ways, it’s a sense of comfort - if you’re worried that you’ll be uniquely incompetent in investing, seeing some familiar faces looking after the same stocks is a quick breath of oxygen.

But this also points at a further advantage of social investing: the decentralization of thought leadership.

Back in the day, you had to read a Warren Buffett book or watch Jim Cramer on CNBC to effectively be in the know. If you didn’t have friends on Wall Street, you might be even further removed from the conversation.

With apps like Public, your friends and neighbors can share insightful ideas, but you’re part of the same conversation. Your friends can invest and you can happily know. Public is even looking to remove economic barriers to entry, by supporting the popular practice of fractional shares, allowing you to invest in stocks even if you don’t have the financial means to buy larger chunks of a stock.

While Public is still young, I do feel it’s doing more than just helping us trade and sell stocks: it’s rewriting a narrative.

Final Thoughts

Why do we love social investing?

I don’t see the value of social investing as a single unit or feature that makes it appealing: it’s an ecosystem of elements. The information, the feed, the social following, the feedback loops, the message chats all give us a sense of familial comfort, a kinship we’ve observed from other social apps we love.

There’s a better byproduct than just simple returns on investment though: If we think about the amount of people in this generation that are now into the fold, it means future generations can inherit the same understanding and love for investing.

While this thesis is focused on how social networks are great for investing, the value I see from Public is a model that can extend to more than just stocks.

Imagine other overwhelming institutions in our life - real estate, mortgages, city governments - areas where the distribution of information is still controlled by influential digital power brokers.

Is there a value in seeing where your friends are buying homes, what your friends think about city government, how your friends consider macro-events in home buying?

This is certainly a start.

On an ending note, I asked Katie for her advice for new Public users (she reminds me that she is not a financial advisor) and it’s advice I think is generally valuable for anyone looking to get involved in investing: Understand your baseline.

“The smart financial advisors I know will always say to pause and think about your goals. Why are you wanting to invest? Is it for 5 years down the line or 50? They also suggest auditing your economic situation and risk profile before getting started. Understanding your comfort level and goals is a solid first step.”

Whether you’re an experienced investor, curious about social investing, or simply looking to get your feet wet…

…. it never hurts to be just a bit more public.

If this piece excited you about the concept of social investing, join me on Public here!

Quick note: The above piece is simply a reflection and does not constitute investment advice. To the extent that any of the content may be deemed advice or a recommendation in connection with a particular security, such information is impersonal and not tailored to the investment needs of any specific person.