Can The Early Internet Explain Crypto Adoption?

Crypto's moment in the Super Bowl ads speculating about how it was the next big thing - but is crypto as revolutionary as the early internet?

If you watched the Super Bowl or read one of the many Twitter threads and ad takes that guzzled out through the night, you likely know that a big theme this year during the game’s ad slots was cryptocurrency.

Coinbase made a bouncing QR ad to a landing page that became so popular that it crashed the app

Crypto.com led with a Lebron James ad where he entertained questions from his younger self about the future

FTX had a fun spot with Larry David skeptically turning down some of history’s best innovations in an effort to juxtapose this with crypto

Etoro had a puzzling one where people who traded on the platform flew into the sky and started to condense into cloud-like bees

You could definitely say these ads had a tremendous upside for the brands -Coinbase, eToro, and FTX skyrocketed in downloads with a collective 279% increase from the week prior.

But what’s interesting is the story the ads actually told.

In research from Pew, about 86% of adults surveyed had heard of cryptocurrency. In that same survey, only 16% had invested, traded, or used it themselves.

You would think that for a country where almost 70% of people who hear of crypto have no interest in using it, crypto exchanges might try and focus more on that schism.

No crypto ads focused on educating non-believers, the benefits of crypto over fiat, or even helping people understand the general landscape beyond mainstream crypto.

My friend Christina Garnett said it perfectly:

The focus was very much on this idea of resisting an inevitable future.

There’s a dramatic moment in Lebron’s commercial where he poignantly tells his younger self: "I can't tell you everything. But if you want to make history. You have to call your own shots."

Nice quote, you think. But then the camera zooms out to introduce Crypto.com branding and you realize that what he just said is essentially a weird metaphor. If you hated Lebron after The Decision and then started liking him again after the Cleveland championship and then felt weird that he sold out to a big market and then were okay with him again after he built the schools and now are suddenly like what are you even doing Lebron, I don’t blame you. It’s a roller coaster.

But, yes, Lebron was basically saying you’re missing out if you don’t invest using crypto.com, the same site Matt Damon was running the cringe “Fortune Favors The Brave” ads.

Crypto.com certainly doesn’t have the same recognition as Coinbase but one thing I found out from a quick google search is that fees to trade on crypto.com are way lower. Certainly a huge incentive for people nervous to start trading crypto or angry at Coinbase for ripping them off. But, alas, what we got instead was some vaguety from Lebron James about how crypto was the future.

There is certainly not a pragmatic reason to stay out, according to the ad. You’re missing out on history.

The Larry David ad with FTX was a bit more straightforward with its premise: Larry David decried the wheel as a useless invention, forks as futile, and even publicly mocked the invention of a toilet. It was, admittedly, a great acting bit from Larry David but which ended in a similar message: Deriding crypto is on the same plane as deriding the next great potential invention in history.

It brought me to something I hear a lot about when it comes to crypto: the comparison of crypto adoption to the internet.

I’ve seen a lot of tweets like this:

Or tweets like this:

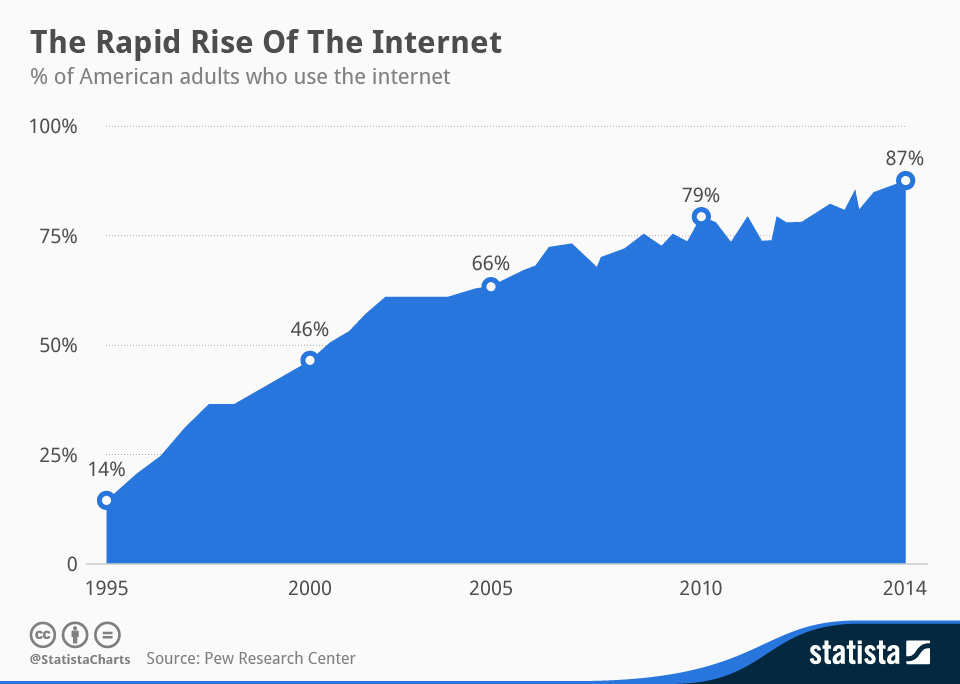

Today, more than 90% of households use the internet. More than 50% of households could not imagine their day-to-day life without the internet. While we can’t see too far back, we know that the idea of a nation largely covered with the internet was considered a pipe dream even as close as 2000, when a mere 43% percent of people had access.

It might seem fun to compare the crypto to the internet given the revolutionary state of the latter to the perceived revolutionary state of the former…

.. But what is the future likely to hold?

Why Did People Hate The Internet?

It’s hard to imagine in a world where more than 150 million people couldn’t imagine a day without the internet, that it was once a fever dream. But how did it even start?

In the 1960s, the Advanced Research Projects Agency (ARPA) began thinking about connecting computers in different locations, with a plan to create a networked system that could stretch across the whole country. ARPANET, a project to build this, was born.

The first edition was modest: four computers connecting remotely into a network. Communication protocols (TCP/IP) were added in the 70s, as was email. While ARPANET grew across mostly research institutions, the public was largely unaware of it. For those who were, they were mostly academics and few saw it having unofficial applications. It wasn’t until 1994 when Bill Clinton’s administration turned internet funding over to the private sector that it finally took off. (Also, Al Gore didn’t invent it but he’s still cool so we’ll give it a pass.)

As soon as it grew, it hit its critics. Resisting the Virtual Life began to immediately criticize the premise of a world with the internet: The economic instability the internet might bring. The cult of the boy engineer and masculinity in its development. The implications of huge amounts of personal data for corporate processing.

The internet came with its villains, skeptics argued. Not only hackers and information abusers, but engineers that would endorse a sort of supremacy over a world that was friendlier to celebrities and politicians. Resisting the Virtual Life editors even wrote:

“There are alternatives to the capitalist utopia of total communication, suppressed class struggle, and ever-increasing profits and control that forgets rather than resolves the central problems of our society.”

The 19990s began to see glimpses of the internet we know today. Wired launched banner ads in 1994. Pizza Hut began to explore digital transactions in 1994. Doom began its first iteration of a shooting game in 1993. Computers got smaller. Operating systems got quicker. CD-Rom drives began to replace floppy disks. The period between 1990 and 1997 saw ownership rise from 15% to almost 35%. 17-dot-com companies spent on ad spots for Super Bowl XXXIV.

The internet became less of a luxury for academics and more a necessity for everyday activities.

Throughout all of this, detractors never stopped.

“The truth is no online database will replace your daily newspaper, no CD-ROM can take the place of a competent teacher and no computer network will change the way government works.” - Cliff Stoll in 1995 for Newsweek

“Most things that succeed don’t require retraining 250 million people.” - Waring Partidge in 1995 for Wired

Even Tim Berners Lee, the inventor of the world wide web, mostly saw it as a way for physicists to vibe, not as a way for anyone to shop for clothes or google potential illnesses.

What’s most interesting about the internet adoption curve is how much of it was centered on the first five years. The internet basically saw the same growth from 2000 to 2010 as it did from 1995 to 2000. While the detractions from 1995 are indeed troubling in today’s context, they were short-lived. 2000 moved more to predictions on what the internet could do vs. whether or not it was a thing.

So what does this mean for crypto?

Will Crypto Have Similar Implications?

I want to preface this by saying I myself own crypto, have bought NFTs, have been involved within the web3 space, and have plenty of friends in web3 - though I love thinking about thought exercises in the space, I don’t love absolutist takes that ignore nuance.

Part of why I wanted to explore this question is because I had seen it so many times and I was curious myself - given what we know about the internet, are we indeed going to see a similar fate with crypto?

First, I do think it’s important to start thinking through adoption at similar triggers.

While bitcoin was launched in 2009 and early versions of the internet were launched in the 70s, I do think we have to play with the same general premise that these have to be commercially available enough for people to have an opinion around adoption.

For crypto, 2013, the year that Coinbase got on its feet, is a more reasonable timeline. For the internet, it’s likely right around 1995.

We often see charts like this:

Not only is it weird to assume a jump from 0 to 1 billion is comparable to a jump from 0 to 100 million, but it’s the idea that the predictive growth rate is exactly comparable in a completely different world where way too many other things are going on.

Here is an even stranger one - basically comparing the internet’s growth until 2000 from 1990 (ignoring three years where barely anyone used the internet) to crypto users from 2014 to now, a world where crypto was commercially available. Another chart ignoring the reality of internet adoption.

But let’s be optimistic and say yes: maybe Coinbase will reach a billion users by 2024 or another crypto exchange will. Is it still safe to conclude what Willy Woo says here about crypto in cryptoslate: “On the question of why mass crypto adoption isn’t here yet, Woo said asking that is the equivalent of an internet user in 1994 asking why no one uses the internet. In other words, adoption is happening right now.”

AOL had barely reached 1 million members in 1995. Netscape and Internet Explorer hadn’t come out in 1995. Crypto adoption has been effectively available since the mid-2010s.

The internet was primed for adoption but it wasn’t close to being ready for the level of adoption crypto is ready for today. Coinbase could get millions of users in one day - AOL was fighting headaches day and night simply trying to get dozens of people to log in at once during the mid-1990s.

So maybe the comparison isn’t adequate purely from a historical standpoint.

But what about the future? If the comparison that crypto is the 1994 internet stands, that means we should ideally see crypto adoption tripling in the next 10-15 years, right?

Interestingly enough, I read this Forbes piece that called the cryptocurrency space dead back in 2018 - well before OpenSea, Coinbase, and others had reached the level of popularity they have today.

Despite it being a bit luddite in its take, the piece had an interesting insight that still rings true today:

“The internet only went mainstream after entrepreneurs—who were not all computer scientists—figured out how to apply the technology’s plumbing to consumer needs.”

More marketers, entrepreneurs, and consumer web advocates are going into web3 and I hope we do see some more plumbing to consumer needs. We are already seeing more NFTs being used by brands (albeit, some haphazard ones) to actually build new retention programs and experiences. Several investors are betting billions in the spaces. Lots has changed since 2018. I’ve written many times about the implications of the metaverse and NFTs themselves.

But I do think web3 has a branding problem.

This isn’t just toxic cults, economics, and over-optimism but it’s the general idea that web3 is hard to explain and not always appetizing to the average person, the same way the internet was with “one-click” and ubiquitous use cases.

For many, the positioning to join is “not missing out” as the super bowl commercials parroted over and over.

I’d argue that the idea of “ownership” and “power to creators” isn’t a game everyone on the internet wants to play. I’d argue there are lots of consumer applications using web3 that could operate without the concept of blockchain technology. I’d argue that some people who define “community” are still operating under an illusion.

But can things change?

Final Thoughts

Yesterday, I was reading Sparktoro CEO Rand Fishkin’s new piece about villains in marketing - it was a concept I was thinking about a lot this morning.

For the internet, the application was clear: things could happen faster. We didn’t need to walk to the store to get new shoes. We didn’t need to call a bunch of friends to get information out. We didn’t need to look across a number of encyclopedias for a specific fact. The things that cost time, energy, and money became our villains.

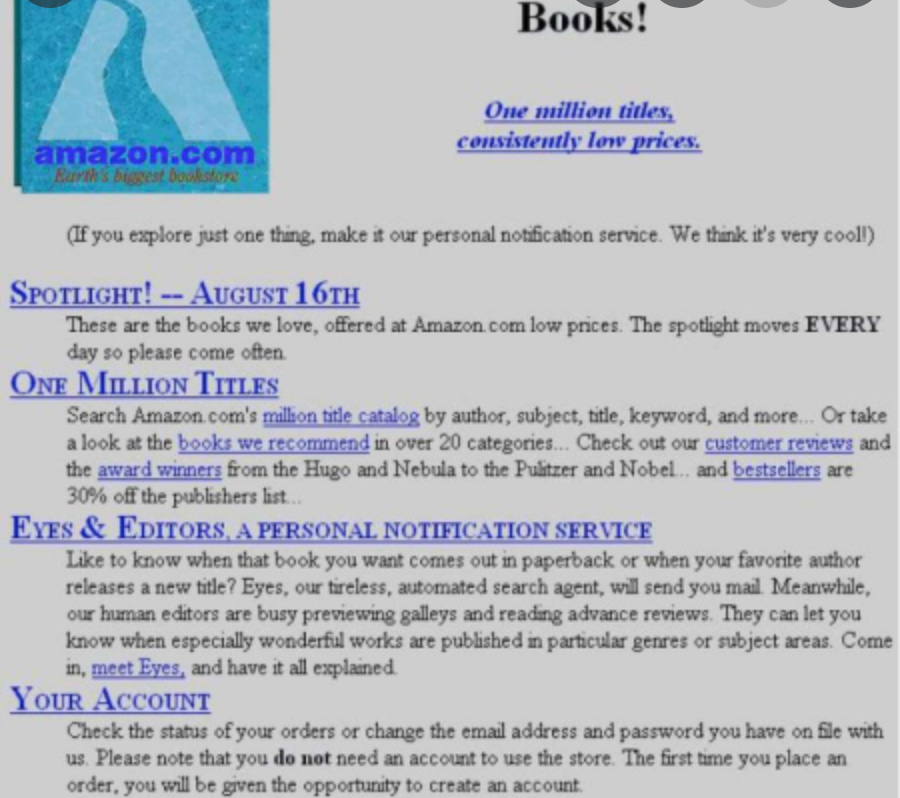

Amazon’s very first website touted the selection - one million titles (imagine finding that in bookstores!) and price.

Even Netflix was taking subtle digs against Blockbuster here.

The villains often touted by Web3 (Web 2.0 sites like Facebook and Google) are hard simply because the masses don’t all hate Web 2.0. Most people are perfectly comfortable using Youtube, Twitter, and Linkedin, and even sites like Wikipedia that don’t have creator incentives are perfectly fine. Web 3 counterparts (like BitClout for Twitter) don’t exactly have the same allure. Maybe they are good villains for some companies (i.e. Google for DuckDuckGo) but for a movement at large?

When I was at IBM, I saw a lot of fascinating implications for blockchains. Even the IBM website has a great example of some: supply chain issues, administrative glut (like visa processes), and even identity management. I’m a big believer in the power of blockchain beyond speculative currency and at the scale that it can get to.

I also see good applications for bitcoin (i.e. driving down costs when sending money overseas with lower transaction fees) and micro coin-based communities. It’s this kind of work that I wish more Super Bowl commercials alluded to when considering the power of crypto.

What I think Web3 needs is more villains to juxtapose the technology against. Not just the social web behemoths but actual processes that can dramatically change someone’s life.

In 2021, it still sucks to stand and wait at the DMV. Couldn’t an immutable ledger help with identity verification, checking driving records, or even renewals without someone checking at every level?

It still sucks to wait for business registration or a visa approval process. But application fraud theoretically becomes harder within a blockchain - couldn’t web3 do something here?

I think we’re definitely early but where we’re early is less on crypto adoption and more on figuring out larger consumer pain points that will get adoption beyond currency.

Could Larry David one day be wrong? Sure.

But instead of celebrating Larry David decrying the wheel, maybe we should actually see him decrying shitty analogies.

The simple answer is No. Electronic data webs started in 1832 with the telegraph system. In the 1950s computers were already talking to each other over phone lines via modems. Modern-looking private webs were publicly visible in the 70s. The HTML version didn't add anything new. At every stage in this very long development, real businesses were using electronic data exchange heavily for real purposes, buying and selling and inquiring about availability.

Crypto began as a blatantly obvious fraud and remains a blatantly obvious fraud. No real business has ever used it for any real purpose. If the real purposes existed, they would have appeared by now.